We have always firmly believed that to generate alpha (excess returns from the stock market), we should select firms that are smaller in size and are fast growing and have a low P/E with low debt. Easier said than done! That’s why we come into the picture; we research heavily into the stocks in which we eventually end up holding a position. With strong research and understanding, we minimize the risk involved while generating above average returns in the medium to long term. Though no investment performance can be guaranteed due to the inherent risky nature of the stock markets, you can be certain that Ganapathi Consultancy and Imports will do its best to ensure that the downside is limited in its investment strategies while making sure the upside is not compromised.

Passive Strategy:

Our investment strategy is a passive investment strategy, it is deliberately passive in order to minimize transaction costs and taxes. There is a short term capital gains tax of 10% (in India), whereas the long term capital gains tax is zero. The cost of trading is also high leading to 1% of investments being tax outgo. This means we do not buy and sell often. We buy with a timeframe of 1-3 years. One of the major factors in our research is the macro economic analysis. We decide to get into a position or pull out of a position after taking into account the economic, social and political environments. If the macro economic analysis indicates that the future is bleak for the whole economy, we sell most/all of our shares and increase our cash reserves and invest later when markets are undervalued. On no account do we advise to blindly buy and sell companies that are not properly researched and whose business model is not well understood. The risk of failure is very high if investments are made blindly (it doesn’t matter if you buy and hold for 1 year or 5 years, a bad stock is still a bad stock and you can lose all/lot of your money). You can read our research reports on the companies in our portfolio in the research reports section.

Your investment needs:

A portfolio is an appropriate mix or collection of investments held by an institution or a private individual. As an investor, you should be aware of your investment constraints and your cash flow needs. Your needs will vary typically based on your age. If you are young and in a job, your short term cash flow needs will all be met by your earnings and you can invest the rest of your money in assets with a medium/long term return perspective. If you are middle aged, you may want to start planning for your retirement and hence, you may not want to risk much of your money in high risk assets and will have a medium term return expectation from your assets. A retiree will have a need for income after retirement from a pension plan/dividend yielding assets with low risk. So, every individual must forecast his needs for the short/medium/long term before deciding which assets to invest in. This includes planning for the short term, the medium term and the long term. A short term forecast can be a forecast of your cash needs for the next one year. Medium term forecast can be for a period of 5 years and a long term forecast for longer durations.

Examples of short term needs:

- Mortgage payments on house/car etc.

- Rent

- Other monthly expenses

- Festival expenses (Diwali, Christmas, Bakrid etc.)

Examples of medium term needs:

- Children’s college/school expenses

- Children’s /Relatives marriage expenses

- Overseas holidays

Examples of long term needs:

- Monthly income on retirement

- Gifting to grandchildren/children in old age

It is suggested that if you are young, you invest 80-100% of your money in stocks, if you are middle aged 50-70% in stocks, the rest in fixed deposits/bonds/low risk assets. If you are retired or close to retirement, your savings should be invested in 20-40% stocks to cover for inflation while the rest is invested in low risk assets that generate a current income.

The importance of cash reserves:

Every investor needs cash reserves in any market. The reason is that cash maybe required for an unforeseeable emergency or an extraordinary circumstance. We recommend that all investors keep at least 10% of their money as cash at all times and invest the rest into assets. Assets may include stocks, bonds, real estate, fixed deposits, mutual funds and fund of funds.

Why should you invest in stocks:

Historically, investments in stocks have outperformed bonds/treasury bills if inflation and taxes are taken into consideration. (Data from CFA Level 1, Book 4, Corporate finance and Portfolio management). Hence, every investor needs a good allocation of stocks in his asset portfolio to beat inflation at the minimum. Any extra returns generated, add to your spending power and help you get closer to achieving your medium-long term objectives.

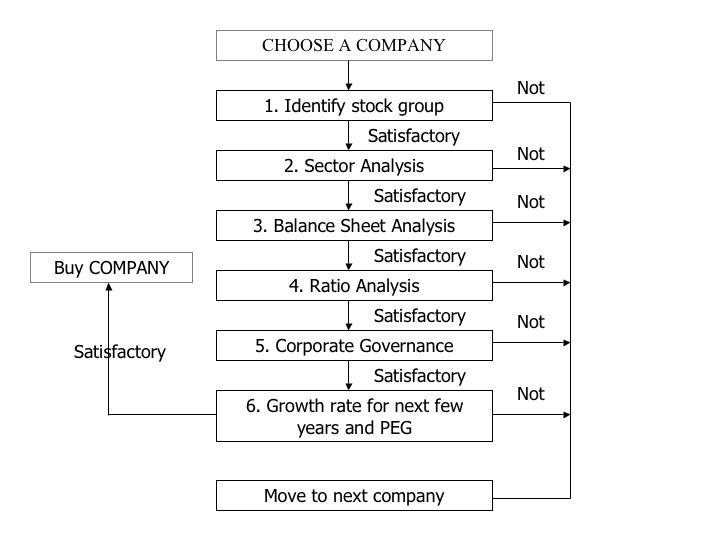

How we choose companies for investment:

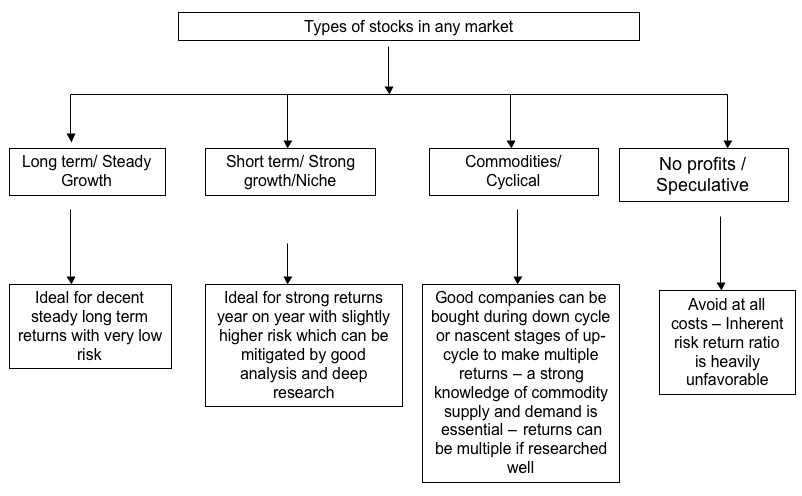

Identifying stock group:

|